Your Anxiety Balance Sheet

My job is hard in some ways but easy in others. Taking on other people’s dreams and fears and goals and stresses isn’t something that can be taken lightly. And I certainly don’t take it lightly. I reduce my anxiety by having a very clear picture of what I know, what I don’t know, what I can control and what I can’t control. I also strive to constantly communicate this to my clients so that their expectations of what I can and can’t do are aligned with this reality.

I recently came across the idea of an anxiety balance sheet from Chip Conley’s blog (I have written about Chip before).

I love this concept.

For most of my clients money anxiety does not come from a lack of money but from a lack of money clarity. What I mean is that they don’t know how much comes in, how much goes out, where it goes. They don’t actually know how much they have.

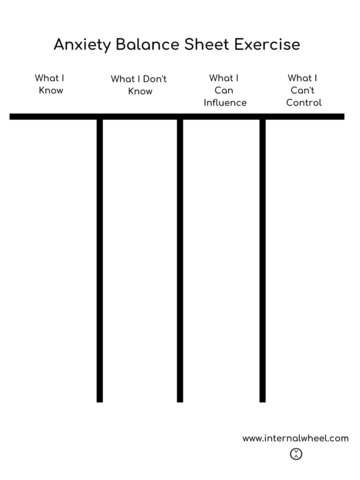

As Chip says “almost all anxiety can be traced to two sources: ambiguity and a perceived lack of influence”. When anxiety strikes he recommends creating a balance sheet of what you know and what you can influence:

“Anxiety lurks in the dark, so this balance sheet acts as an illuminating flashlight.”

I have created my own anxiety balance sheet below:

This is a useful exercise as we approach the end of the year. If there are things in the ‘I don’t know’ column that you could or would like to know, make them a priority for 2020. Likewise look through the list of things you can influence. If there are financial items on there, are they things I could help with? If you are already a client, send me the list and we will work on it together. If you’re not yet a client, take the first little step towards reducing your anxiety – hit reply to this email and let’s talk it through.

Georgie

georgie@libertywealth.ky