A Year On; The Advice I Gave

On March 20th 2020, three days before the market bottomed I wrote a blog titled ‘Is this different’?

I said, yes, of course this is different. Every crisis is different at the start. Every crisis has a different catalyst – the Cuban Missile Crisis, the Asian Financial Crisis, the Twin Towers, the Great Financial Crisis. They were all totally different.

Morgan Housel wrote this week:

If you went back to last January and said, “What does the world look like if no one can go to the office, face-to-face interaction is gone, every school is closed, half the world is on sporadic lockdown with people banned from leaving their home, and it stays like that for a full year?”

I think you would have said, “My god, that’s the end of the world. This will be 10 times worse than the Great Depression.”

Of course, we all know what actually happened. The US Government (and others) embarked on a stimulus program never seen before and the US consumer (as a whole) flourished. We produced a vaccine in record time and we are now approaching herd immunity.

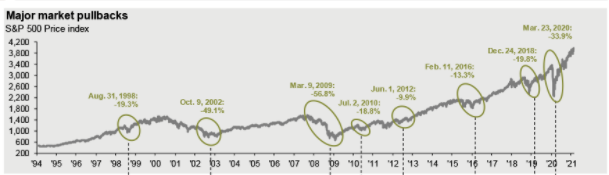

The S&P 500 bottomed on March 23rd 2020 at 2237 (on a closing basis – it actually traded below 2200 during that day) having fallen 34% in 22 trading days. As I write, the S&P 500 is trading at an all-time high of 4128.

2237 to 4128 in a little over a year. That’s an 84% return.

According to Nick Magguilli, there have only been two other periods since 1915 that had higher returns over the prior years. Both of those periods occurred in the early 1930s in the recovery from The Great Depression.

The important point of my blog on March 20th last year was that whilst every crisis is different at the start, the ending is always the same – we always get through it. We humans prove our amazing resilience and ability to adapt, and the crisis always ends.

I wrote a year ago:

The stock market reflects the human spirit and our collective human ingenuity. It will recover the way it always has. When is that day? I don’t know. But here’s something important to understand about markets.

Markets move on expectations. They are fed by human emotion, by greed and fear. And they overreact in both directions. What this means is that the markets do not need the news to be getting better before they start climbing again. They don’t need the dust to settle. They don’t need a vaccine to be found.

What they need is for the news to just be a little less worse than they are expecting.

I had no idea when the market would turn, only that it would turn. I didn’t know that just three days later it would start a relentless march upwards. No one on the planet knew that.

I didn’t call anything. I simply gave you the advice that has always, always, ALWAYS been the right advice. I told you:

Have faith that this time isn’t different. Have faith that the human spirit and human ingenuity will prevail.

Be patient whilst the market recovers. We are not in a hurry.

And stay disciplined. If your plan calls for monthly or quarterly additions, keep buying*.

Finally, you know this, everyone knows this…..the golden rule.

Buy low, sell high.

Don’t do the opposite. Please, please, whatever you do, don’t do the opposite. Don’t hit that button. Betting against the human spirit and human ingenuity has never paid off. Never. We can’t bet against it today.

I want you to know this. Many other investors did not get that advice. It was so easy back in March of last year to believe that everything had changed and the world would never be the same again. A staggering $241 billion was pulled out of US equity funds during 2020 (according to Morningstar). Every single one of those investors has missed out on the permanent advance.

Now we are out of this crisis I can tell you this; I will give the exact same advice the next time we face this test. I have no idea what the next crisis will be. It’s most likely something that no one is talking about or even thinking about. It’s probably going to be something that has never happened before. But when we find ourselves deep in the crisis I will stand steadfast once again between you and that deep human desire to do precisely the wrong thing at exactly the wrong time.

My advice will be the same because my philosophy never changes.

And remember, a philosophy is very different to an outlook. An outlook changes all the time. If all you have is an outlook you will be up and down like a yo-yo. You will always be reacting to an event or a crisis or a circumstance or a change that you didn’t forsee.

That is a recipe for disaster. And sadly, it’s all most people have (professional investors included).

But, a philosophy. A philosophy (as my friend Nick Murray says) is impervious to circumstance. A philosophy gives us something on which we can continuously and positively act (and doesn’t that sound like something we ought to do?).

The philosophy, stated in the most simple terms is:

· Equities (the great companies of the world) have compounded at something in the region of 10% per annum over the past 200 years.

· The premium return of equities over bonds comes because the return in any given year may be sky-high, extremely poor, or somewhere in between. The term used for this is volatility. There is volatility around the long-term uptrend, both on the upside and the downside (volatility works both ways).

· The declines in prices, whilst sometimes significant (see chart below), have always been temporary. The declines always give way to the resumption of the permanent uptrend.

· There is no known, consistent way to time the equity market – that is, get out at the top and in again at the bottom. If you are lucky and you get out at the top, you have made only half a decision. You have to know when to get back in again. And so it goes on.

· Therefore, the only way to benefit from the full permanent return of equities is to ride out all the temporary downturns.

Or as I always like to say, you can’t stop the waves but you can learn how to surf.

Georgie

georgie@libertywealth.ky