Get Rich Quick (Or Get Poor Quick?)

Someone in the UK won 184 million pounds on the lottery this week. Overnight, they became worth more than Adele and Harry Kane.

I wouldn’t wish that on anyone. History is full of stories of overnight fortunes being made, and overnight fortunes being lost. Mostly, there is more misery than happiness. Relationships fall apart, people are exploited and good decisions are hard to make.

Getting rich quick and getting poor quick are two sides of the same coin. Some unfortunate lottery winners can attest to that, as can many of those who have recently entered the stock market.

Peter Bernstein once said, the riskiest moment is when you are right. It’s one of the most profound comments about investing in the stock market.

Investing over the last few years has seemed easy for those that we might call ‘unseasoned’. Markets kept going up, and if all you bought was highly valued tech stocks and crypto, you may well have made a fortune. It was easy to laugh at those oldies – those that said valuation matters, those that cautioned against putting all your money into the hot thing. What did they understand about the new world, the new order? We had entered a world where the old rules no longer applied.

Well, we hadn’t of course. All it took was inflation and a couple of interest rate hikes for those assets that had gone up the fastest to come crashing back down. Like, really crashing down. The high growth tech stocks are in Great Depression style drawdowns.

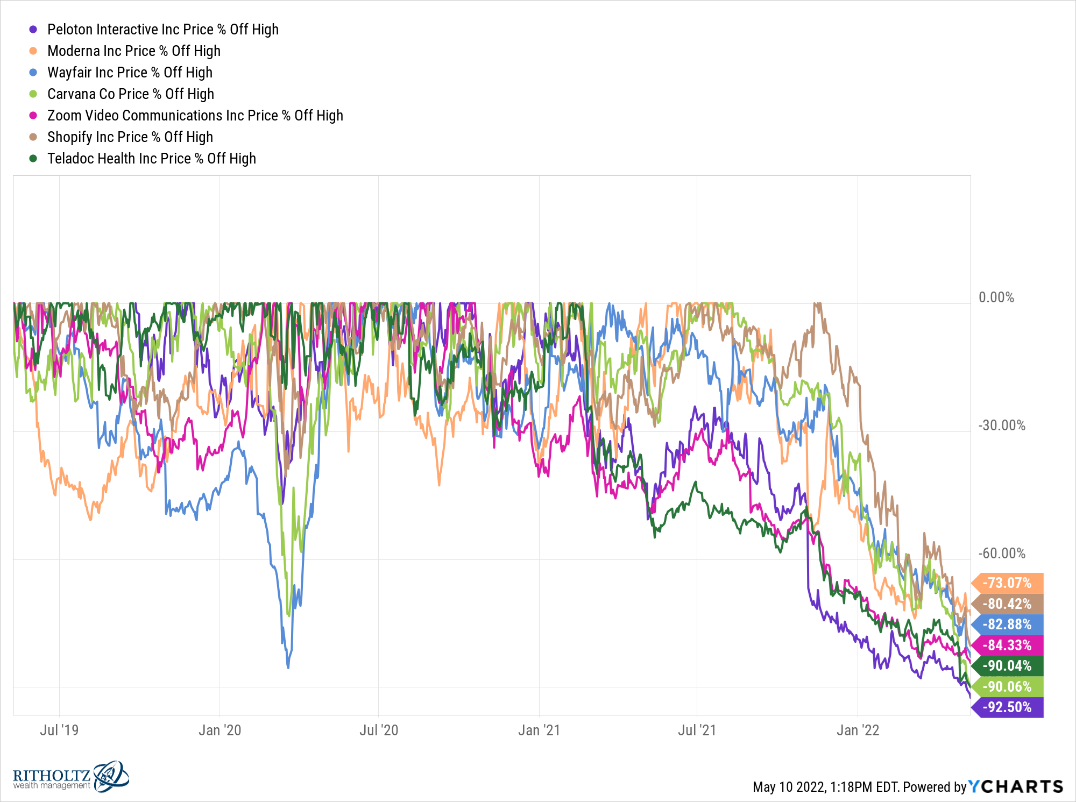

I am sure this chart from Ben Carlson sends shivers down some people’s spines. It shows the peak to trough drawdowns on some popular stocks.

Peloton has fallen 92% from its high. Zoom is down 84%, Shopify has collapsed 80%. These stocks were the darlings of the pandemic and there are a lot of (particularly young) investors that owned those stocks and nothing else. They got rich quick, and then poor even quicker.

As I said, two sides of the same coin.

The story is the same in many areas of the Crypto market (Dogecoin is down 90% from its high) – up in a hurry, down in a hurry. Stablecoin it turns out isn’t so stable (who would have thought that a guaranteed mid-teen return wasn’t guaranteed at all). Ditto the SPACs and basically anything else where people thought valuation didn’t matter anymore.

Valuation doesn’t matter until it does, and then it really does.

Here is the story of Cathie Wood; until a few months ago, one of the best performing fund managers of all time. Now her ARK Innovation Fund is lagging the S&P 500 since the March 2020 crash.

Slow and steady wins the race?

You bet it does.

We are absolutely seeing temporary losses in our client accounts, but we aren’t blowing up. We had stuck to the principles when it mattered.

Investing is not easy. It was never easy. It requires patience, faith and discipline. It requires a temperament that can avoid the pull of greed and fear when others are consumed by it. It requires an understanding of human psychology and the human condition. It requires a knowledge of history and, at the same time, the ability to acknowledge that things that have never happened before can happen at any point.

If you have those attributes and can work at getting better at those things day in and day out, then you should be managing your money yourself. If not, you might be best served by having a trusted guide by your side, someone who can help at the extremes of market action when human nature and emotions want to take over.

Remember, all bear markets feel like a risk at the time but are always an opportunity in hindsight.

“You make most of your money in a bear market, you just don’t realise it at the time.”

Georgie

georgie@libertywealth.ky