What is the real cost of a career break?

I have long known that women deciding to take long career breaks to care for their children are doing so without a full assessment of the financial planning impacts. I am a mother of three children so I certainly realise that there is far more that comes into the discussion than just finances. But if money is part of your motivating decision to stay home, then you need to make sure you are looking at the maths the right way. I know many women look at what they are earning versus the cost of childcare and conclude that it is simply not financially worth them going to work. If I asked you to calculate the cost of a career break, the simple equation you would probably use is number of years off times salary equals financial cost. So if you planned to take five years off to care for your kids, and your salary is $85k, you might conclude that the cost of your career break is $425k.

However, over the course of your career it is going to cost you many many multitudes more than that.

Here's why.

According to an Ellevate Network survey (August 2015), one if five women reported a pay cut of 20% or more after taking a career break. That's huge. And then compare that with the pay increases you would have probably received if you had stayed in the work force for those five years. Then compound that over your lifetime. Your pay rises when you return to the workforce are coming off a lower base.

One study has looked at a 30 year old professional woman, earning $85k a year who takes a two-year career break in five years time. On return, she takes a 20% pay cut (this feels about right to me based on my many conversations with women over the years). The real cost over her 40 year career? $1.7m. Yes, one million and seven hundred thousand dollars.

The thing is that it's not just lost income, it's lost income growth, lost retirement benefits and the opportunity cost of not having that extra money to invest.

But, like I said, it's not just about the money. I know that. And I am certainly not making any moral judgement either way. I'm just putting the figures here so decisions can be based on the correct information.

Carl Richards talks about the cost of his wife staying home to look after his children in a blog. He explains it beautifully. After 20 years of her looking after their four children, they looked back at the decision and concluded it cost them more than a million dollars in lost income alone. However, he asked the question 'what is the value of the work she did with our four children over those 20 years?'.

He goes on..."We can’t calculate the emotional value using a spreadsheet. But here’s one way to think about it. We have a family balance sheet that includes the normal list of assets and liabilities. But down the balance sheet a bit, we also have a line item that reads, “Cori being a full-time mother.” We placed a high value on that decision because we knew someone needed to be there for our four children. Cori wanted that someone to be her."

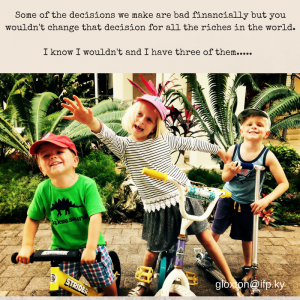

I love his concept of incorporating an emotional balance sheet into your financial planning. Other things that might go on it are family, relationships, time to yourself. Things that you can't put a figure on. Some of the decisions we make in life are bad financially (having kids in the first place, for example - the cost of raising one child has been put at over a million dollars) but you wouldn't change that decision for all the riches in the world. Well, I know I wouldn't and I have three of them.